Get This Report on Fortitude Financial Group

Wiki Article

An Unbiased View of Fortitude Financial Group

Table of ContentsWhat Does Fortitude Financial Group Do?Our Fortitude Financial Group DiariesThe 9-Second Trick For Fortitude Financial GroupExcitement About Fortitude Financial GroupAn Unbiased View of Fortitude Financial Group

Keep in mind that numerous experts won't handle your possessions unless you meet their minimal demands. When choosing an economic consultant, find out if the specific follows the fiduciary or suitability criterion.The wide field of robos covers platforms with access to monetary advisors and investment monitoring. If you're comfortable with an all-digital system, Wealthfront is an additional robo-advisor alternative.

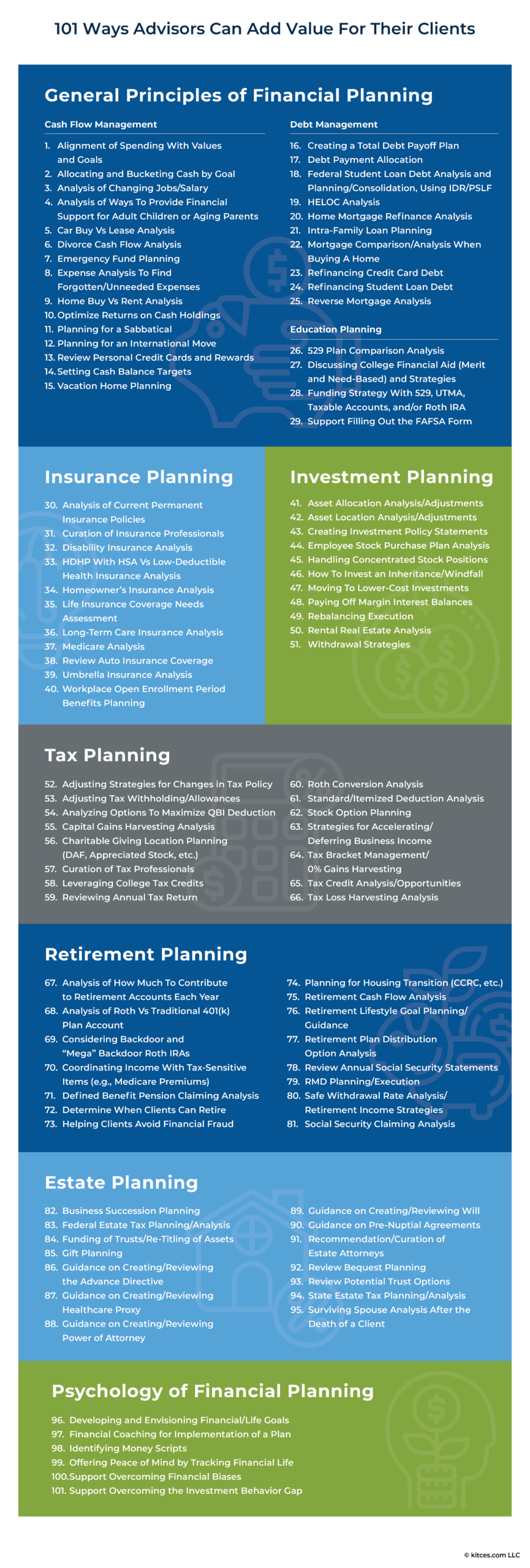

You can discover a monetary advisor to assist with any type of element of your economic life. Financial experts may run their very own company or they could be part of a larger office or bank. Regardless, a consultant can assist you with everything from building an economic strategy to spending your cash.

The Fortitude Financial Group PDFs

Think about dealing with a monetary consultant as you develop or customize your economic strategy. Finding a financial consultant doesn't have to be difficult. SmartAsset's cost-free device matches you with up to three vetted monetary consultants that offer your location, and you can have a totally free introductory telephone call with your expert matches to make a decision which one you feel is right for you. Examine that their qualifications and abilities match the services you want out of your advisor. Do you desire to learn more regarding monetary advisors?, that covers principles bordering precision, trustworthiness, editorial self-reliance, know-how and objectivity.Most individuals have some psychological connection to their money or the important things they purchase with it. This psychological link can be a main reason that we may make poor monetary decisions. A specialist monetary expert takes the emotion out of the equation by offering unbiased suggestions based on knowledge and training.

As you undergo life, there are economic choices you will make that may be made more quickly with the assistance of a specialist. Whether you are trying to reduce your debt lots or want to begin preparing for some lasting goals, you can gain from the solutions of an economic consultant.

Fortitude Financial Group for Dummies

The essentials of investment management consist of buying and selling economic possessions and various other financial investments, but it is much more than that. Managing your financial investments entails comprehending your brief- and long-term objectives and making use of that details to make thoughtful investing decisions. An economic expert can give the data necessary to help you expand your financial investment portfolio to match your wanted level of danger and fulfill your monetary goals.Budgeting provides you an overview to just how much money you can spend and exactly how much you should save each month. Adhering to a budget plan will certainly help you reach your short- and long-lasting monetary goals. A financial advisor can assist you outline the action steps to take to establish and maintain a budget plan that works for you.

Occasionally a medical expense or try this web-site home repair can unexpectedly include in your debt tons. A professional financial debt management plan helps you repay that financial debt in the most economically helpful way possible. A monetary expert can assist you assess your financial debt, focus on a debt payment method, supply alternatives for financial obligation restructuring, and lay out an all natural plan to much better handle financial obligation and meet your future monetary objectives.

The Best Strategy To Use For Fortitude Financial Group

Personal cash circulation analysis can inform you when you can manage to get a new vehicle or just how much cash you can include in your cost savings each month without running short for necessary expenses (St. Petersburg Investment Tax Planning Service). A financial consultant can aid you clearly see where you invest your money and after that apply that insight to aid you recognize your monetary well-being and exactly how to boost itThreat administration services determine prospective risks to your home, your car, and your family, and they assist you put the right insurance policy plans in position to minimize those risks. A monetary advisor can help you develop a method to secure your gaining power and minimize losses when unexpected points take place.

Unknown Facts About Fortitude Financial Group

Reducing your tax obligations leaves more money to add to your financial investments. Financial Services in St. Petersburg, FL. A monetary consultant can assist you make use of charitable providing and investment techniques to reduce the amount you must pay in tax obligations, and they can reveal you just how to withdraw your cash in retired life in a method that likewise reduces your tax worryEven if you really did not start early, college planning can help you place your kid through university without encountering suddenly large expenditures. An economic expert can direct you in recognizing the very best methods to conserve for future college expenses and just how to money possible gaps, describe just how to decrease out-of-pocket college prices, and encourage you on qualification for economic aid and grants.

Report this wiki page